The reality of COVID-19 stimulus checks for college students

April 2, 2020

You’ve most likely heard of the rumored stimulus checks that will be sent to Americans in response to the coronavirus pandemic. An extra $1,200 sounds like a great deal, right?

For some, it will be – but there are a lot of strings attached to that money.

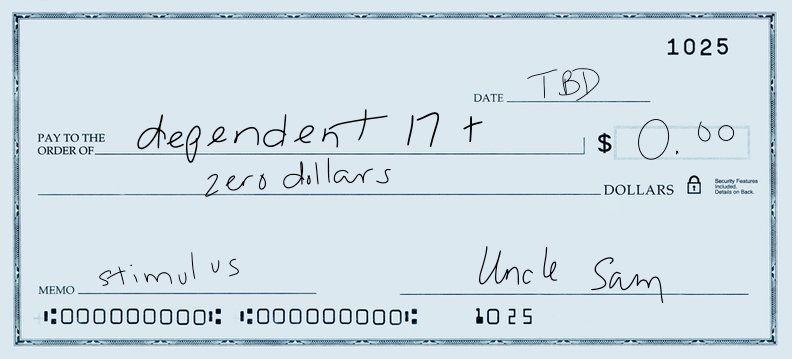

The rules sound simple at first. All American adults get $1,200 from the government and an extra $500 for each dependent. Not quite. It turns out that many college students and other adult dependents won’t be eligible for any money at all.

There are earning, age and tax filing requirements in order to be eligible.

Individuals who make less than $75,000 and couples who make less than $150,000 will qualify for the full amount.

However, only parents who have dependents under 17 will be eligible to receive an extra $500.

This means that a vast amount of college students won’t be receiving anything from the bill. If your parents claim you as a dependent and you’re 18 or older – you will get a whopping $0 from the stimulus bill.

“Even though I’m not somebody who vitally needs a check, it made me upset because I have friends who do need that money,” said Ethan Nelson, a sophomore English major. “It didn’t affect me personally [but] I felt angry on behalf of my friends who are in a scary financial state.”

It is common for parents to claim their full-time college student as a dependent. Especially if they help with any expenses.

“In order for your parents to claim you as a dependent – your parents have to cover at least 50% of your living expenses,” said Paul Byrne, associate professor of economics at Washburn University.

Byrne explained child tax credit.

“The child tax credit [is where] you get a refundable tax credit based on the number of children you have,” said Byrne. “That’s also based on the age of 17. It’s set up with the same type of structure. The extra $500 is basically set up above and beyond a child tax credit, so it has to be the same basic set up and the same basic rules.”

Recent events have opened the eyes of Kim Korber, senior mass media student, when it comes to taxes.

“I’ve always filed dependent because my parents have always claimed me. I’ve never thought to argue with them,” said Korber. “I do know after this whole thing that I will be having a talk with them. My parents don’t [help] pay for my expenses.”

Although many college students won’t qualify for the stimulus checks, if they lost their job or are working less now because of COVID-19 – they may be able to qualify for unemployment.

“The enhancements to the unemployment insurance are significant. You get an extra $600 a week for up to 4 months above and beyond from what you would be getting from the State of Kansas. I imagine that would be a big positive for students who have been laid off from their jobs,” said Byrne.

There is a lot of scrutiny surrounding the government and what they are doing to ease financial burdens for Americans. Unfortunately, there is no perfect answer.

“They’re trying to get it out there and out there fast so that the economy stabilizes. It was an argument to do things quick instead of doing things perfectly,” said Byrne.

For more information about the coronavirus, please visit https://www.cdc.gov/coronavirus/2019-ncov/index.html and for more information about the stimulus checks please visit https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

Edited by Wesley Tabor, Diana Martinez-Ponce, Hannah Alleyne