College textbook tax break proposition’s possible affects

January 29, 2019

The price of attending college adds up quickly. Kansas representative Nick Hoheisel, District 97, strives to lessen that burden by pushing for college textbooks to be exempt from sales tax.

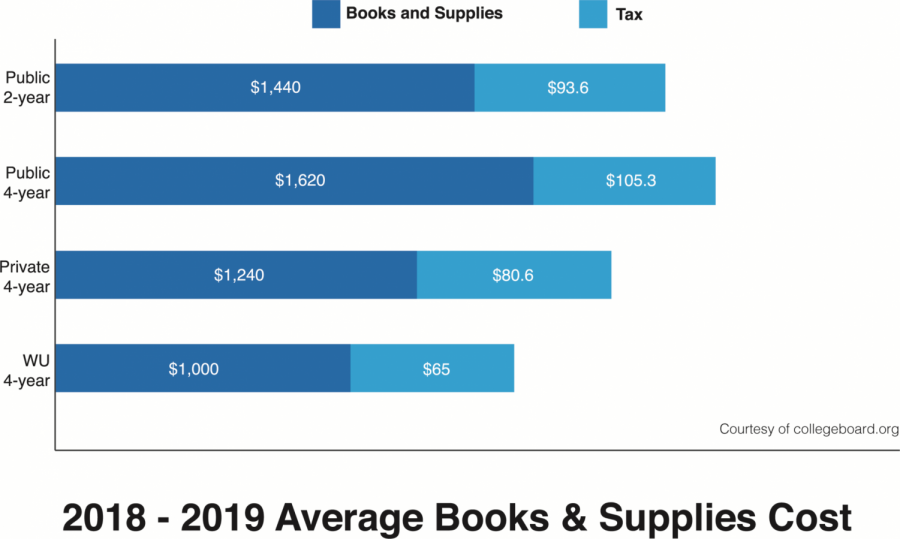

Though House Bill 2011, Hoheisel proposes to exempt the state tax on required textbooks for higher-education, both public and private. Thus, the current Kansas state sales tax rate of 6.5 percent may not be applied to college textbook purchases.

Explicit details regarding whether county, city or municipal taxes would be exempt as well have yet to be revealed. In addition, online purchases raise questions for how or if this bill would affect state sales tax on textbooks.

During college, Hoheisel had to pay a lot of money so he could purchase required course materials. With House Bill 2011, he wishes to help soften the school-related expenses for college students.

Townhall reports on their website that Hoheisel understands that the Kansas government can’t reduce textbook prices, but they can still support students by not taxing their required course material purchases.

Although House Bill 2011 is only a proposition until the hearing in February, it began raising questions for the Washburn community. In particular, how this would affect the Ichabod Shop, Washburn’s bookstore.

Karen Peterson, director of Ichabod Shop, has worked at Washburn for 3 1/2 years. Peterson graduated from Ottawa University, and she used to work as a course material manager in the college bookstore.

“The information we currently have is very vague and we are confused if it’s going to be county, state or the city taxed,” Peterson said. “Because that poses a possible problem with the current POS [Point of Sale] system, how we sell the book and how taxes get allocated.”

Janet Tenholder, Kansas State graduate, is course material manager for the bookstore.

“Washburn is one of very few institutions that receive funds from city taxes, as we are a municipal university, so I’m not certain how that [House Bill 2011] would affect the students here,” Tenholder said.

Because of the lack of clarification regarding what all House Bill 2011 will entail, it is difficult to determine what will be deemed eligible and qualify for tax breaks.

“They didn’t think about the ripples. Textbooks are not the only course material in today’s world. There are access codes, notes and other online material,” Peterson said. “It needs to be defined if only textbooks are not being taxed or if other materials are, too.”

They also publish the list of courses required on the website for the university because it’s a part of a government act to list the required, recommended and alternative to the textbook. The bookstore represents all of the stock available in the store on their website to provide easier access for students.

The press release for House Bill 2011 was vague, giving just a brief, general description. With very little clarification on what all the bill entails, how Washburn will be affected is still undetermined.

“It’s hard to tell at this point if this tax break will help or hurt us. There will be possible changes or rewriting of our POS system that might cost us some money,” Peterson said.

She explained that this tax break would be helpful to students, but at this point, it is unclear how the bookstore’s processes will be altered.

The bill’s hearing will be in February at the Capitol where its fate will be determined. Once the bill is forwarded, refining the bill and qualifications for tax relief should soon follow.