‘The Dave Ramsey Show’: The borrower is slave to the lender

March 25, 2019

Money can make you feel free or trapped in the life you are living.

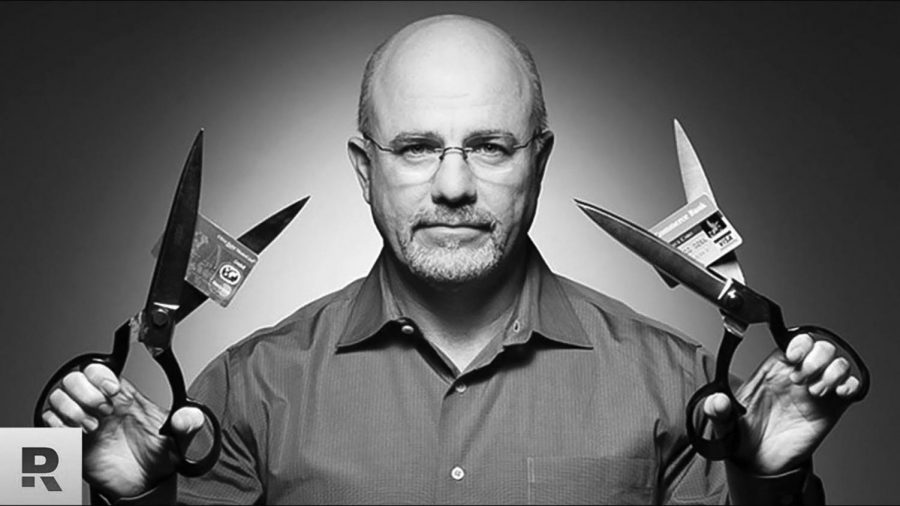

“The Dave Ramsey Show” is a three-hour radio program and podcast, hosted by the show’s namesake, a well-renowned finance author and speaker, Dave Ramsey.

As a real estate investor, Ramsey faced personal bankruptcy as Ramsey Investments, Inc., worth more than $4 million, went under in 1986 when he could not pay. The advice he provides his listeners is as he claims, “nothing I haven’t had to do myself.”

Ramsey climbed his way out of bankruptcy and back into the 1 percent, now netting somewhere around $60 million.

In his podcast, Ramsey takes live calls on the theme of finance as it pertains to navigating the treacherous waters of student loans, car payments and home mortgages.

“Too often, our money problems grow into some kind of monster hiding in the closet, growing bigger and badder and scarier every day that we keep them hidden but if we want to change the behaviors that get us into trouble, we’ve got to kick the monster out of the closet and laugh at him,” Ramsey said.

Ramsey gives no-nonsense advice to folks who have gotten in over their heads, and helps them to find their way out in a responsible way. If you’re afraid of hard work, you may want to look elsewhere for your advice.

In addition to his best selling books and radio and TV shows, Ramsey also teaches “Financial Peace University” at huge live events and the “7 Baby Steps” are an offshoot of the FPU class.

Ramsey’s “7 Baby Steps” include,

– Baby Step 1, put $1,000 to start an emergency fund.

– Baby Step 2, pay off all debt using the Debt Snowball.

– Baby Step 3, put three to six months of expenses in savings.

– Baby Step 4, invest 15 percent of household income into Roth IRAs and pre-tax retirement.

– Baby Step 5, start college funding for children.

– Baby Step 6, pay off your home early.

– Baby Step 7, build wealth and give.

According to the Pew Charitable Trusts, a full 80 percent of Americans have some form of debt. People take on debt for all kinds of reasons, whether it’s going back to school, paying for a house or dealing with one of life’s emergencies. Regardless of your individual circumstances, being in debt can be tough on your wallet and more importantly the relationships with God, family and friends.

In the Bible, Proverbs 22:7 (NIV) states “The rich rule over the poor, and the borrower is slave to the lender.”

Ramsey has made constant reference to this verse throughout his 27 years of service. He speaks to the relevance of this verse in all seasons of life. Borrowing money that you do not have, whether with loans or paying with credit, is off limits in the world of Ramsey.

This outlook on life that Ramsey gives his listeners is refreshing. I never would have thought I would be listening to 10 hours a week of financial advising from this hick in Nashville, Tennessee, but I am hooked. The lifestyle and state of mind Ramsey presents his listeners with day in and day out is contagious.

I give this podcast 5 out of 5 top hats.